How Do You Subtract Hst From A Total

For example say you sold 10000 worth of hot food and the sales tax on hot food is taxed at 8 percent. Fix the reference to cell A8 by placing a symbol in front of the column letter and row number A8.

Mathematics For Work And Everyday Life

100112X which is the same as 1112X.

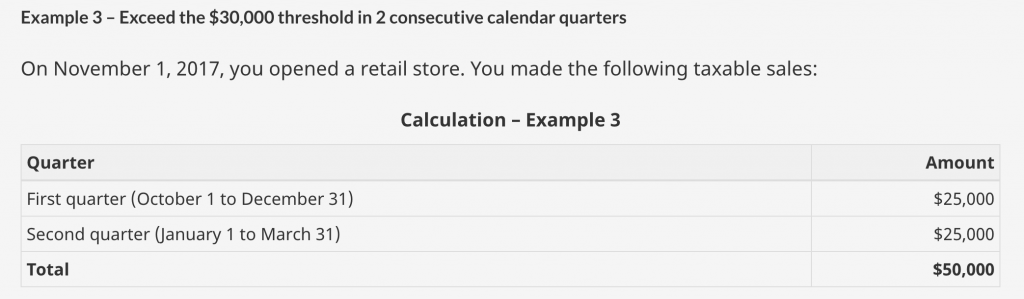

How do you subtract hst from a total. In the example below B5 has been multiplied by 015 which is the same as 15. To calculate net tax for your quarterly or annual GSTHST returns you will need to follow these steps. Subtract the pre-tax price and the general sales tax from the total price.

Add up all GSTHST your business gained within the relevant accounting period. The rate you will charge depends on different factors see. For example since 700 - 625 - 3125 4375.

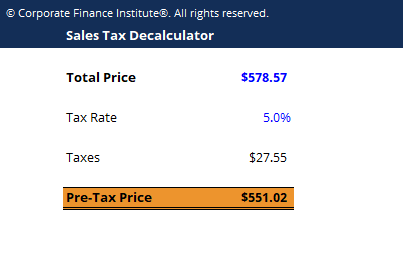

That means the total sales for hot food -- not including sales tax -- is 10000 divided by 108 or 9259. This calculator can be used as well as reverse HST calculator. Multiply the result from step one by the tax rate to get the dollars of tax.

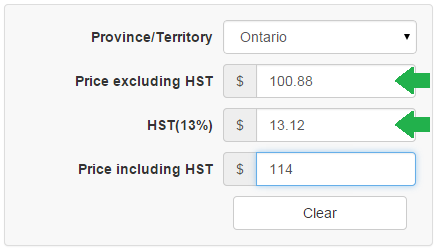

In this example sales tax is 10000 minus 9259 or 741. The following table provides the GST and HST provincial rates since July 1 2010. How to use HST Calculator for reverse HST Calculation Enter HST inclusive price on the bottom.

There is no SUBTRACT function in Excel. In other words if the sales tax rate is 6 divide the sales taxable receipts by 106. If X then original was.

This is the provincial tax. If 112 then original was 100. Enter that total price into Price including HST input box at the bottom of calculator and you will get excluding HST value and HST value.

Divide the Post-Tax Price by the Decimal. Enter your name and email in the form below and download the free. Type of supply learn about what supplies are taxable or not.

The result 100 is the amount of your original purchase with no tax. This is very simple universal HST calculator for any Canadian province where Harmonized Sales Tax is used. Divide the bill for the goods or services by one plus the GST.

Amount with sales tax 1 HST rate100 Amount without sales tax. Subtract the total figure of. On March 23 2017 the Saskatchewan PST as raised from 5 to 6.

This is your bill without GST. Subtract the total receipts from the ending figure from step 3 to calculate the amount of tax owed on the department receipts. Where the supply is.

Divide the total amount you paid by one plus the percentage of tax that was charged. Use the SUM function and convert any numbers that you want to subtract to their negative values. For example if you spent 112 and the total tax rate was 12 percent divide 112 by 112.

As of November 2010 the GST rate was 5 percent. You have a total price with HST included and want to find out a price without Harmonized Sales Tax. Select the province you need to calculate HST for and then enter any value you know HST value OR price including HST OR price exclusive HST the other values will be calculated instantly.

If the GST is included in the value of supply. Calculating Amount of Tax Paid. HST does not apply to most resale homes.

Take the total price and divide it by one plus the tax rate. Multiply the before tax figure by the current GST rate. To find the total including GST simply add the two values together.

Forest Hill Real Estate 9001 Dufferin Street Unit A9 Vaughan Ontario. Convert the Total Percentage to Decimal Form. In the example if your bill including GST was 229 then 229 divided by 105 equals 21810.

To subtract a number from a range of cells execute the following steps. Formula for reverse calculating HST in Ontario. If the sales tax rate is 725 divide the sales taxable receipts by 10725.

Subtract the Pre-Tax Price From Post-Tax Price. Substitute the cells containing the tax and the total price in the above formula. For example SUM 100-3215-6 returns 77.

GSTHST provincial rates table. Calculate how much GSTHST your business paid on purchases. Enter Price Add Or Subtract HST from the price.

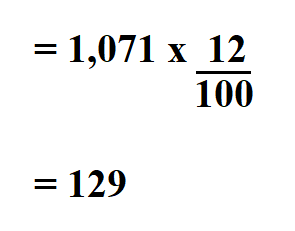

The total amount of goods Total value of goods GST amount. The quick method remittance rates are less than the GSTHST rates of tax that you charge. To calculate the net GSTHST to remit multiply the amount from your taxable supplies including the GSTHST made during the reporting period by the applicable quick method remittance rate s.

Subtract your bill without GST from Step 2 from the bill for. Add 100 Percent to the Tax Rate. Subtract the dollars of tax from step 2 from the total price.

GST Amount 2000x 12100Rs. Use the SUM function to add negative numbers in a range. Or more generally 1 1tax X.

First subtract the value in cell A8 from the value in cell A1. Tushar Mehta MVP Excel 2000-2015 Excel and PowerPoint tutorials and add-ins. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate.

GST Amount Value of supply Value of supply x 100 100GST Consider that the total cost of the procurement of goods is 2000 and the GST tax rate is 12. See the articleTax rate for all canadian remain the same as in 2017. Current HST GST and PST rates table of 2021.

To do this you simply multiply the value excluding GST by 15 or by 015. Download the Free Sales Tax Decalculator Template. Amount without sales tax x HST rate100 Amount of HST in Ontario.

How To Complete A Canadian Gst Return With Pictures Wikihow

Mathematics For Work And Everyday Life

Cpc Charging Incorrect Hst Gst The Ebay Canada Community

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

Is Being Charged Gst Hst Tax For The Free Games That Come With A Gpu Normal Bapccanada

Bookkeeping Tutorial Archives Lisa Savage Bookkeeping Services

Mathematics For Work And Everyday Life

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Mathematics For Work And Everyday Life

How To Calculate Sales Tax In Excel

Quick Method Of Hst Collection Madan Ca

Sales Tax In Canada Hst Gst Pst When You Re Self Employed

Reverse Hst Calculator Hstcalculator Ca

Formulas To Include Or Exclude Tax Excel Exercise

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Calculate Sales Tax Backwards From Total